Before filing for a mileage tax refund, you should understand the rules and regulations concerning the deduction. To know what type of deduction you can claim, check out IRS’s publication on transportation. Also, you should consider whether you should claim vehicle expenses instead of mileage. To file for a mileage tax refund, you must keep proper records to avoid a fine. But before filing for your mileage tax refund, you must determine how many miles you’ll be traveling in a given year.

Recordkeeping

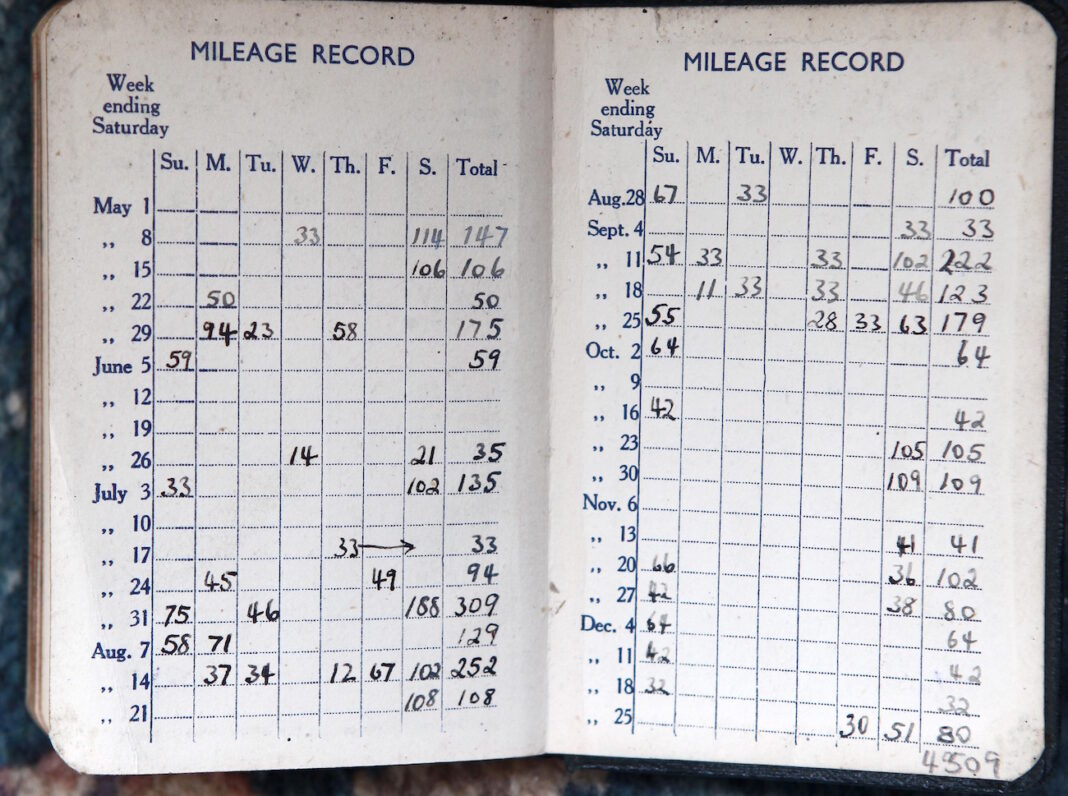

If you use your vehicle for business, it’s essential to understand recordkeeping rules when planning to claim a mileage tax deduction. The IRS has specific rules regarding keeping accurate mileage logs, and your employer may have guidelines on how to easily log your mileage for taxes. This article will discuss keeping the most accurate records to meet IRS standards. We’ll also talk about the most efficient ways to log your miles.

When planning to claim a mileage tax deduction, it is critical to note the reason for the trip and any business-related purpose. While a detailed record of each customer may be sufficient for an audit, backup documents should also be kept for reference. Invoices or bills with a trip description are essential if the IRS ever conducts an audit. To avoid these complications, keep track of your business mileage logs and keep them current.

Standard mileage rate

The IRS keeps track of the standard mileage rate so that you can calculate how much you can deduct for using your vehicle for business purposes. The standard mileage rate for business purposes was 58.5 cents per mile in 2021 and is expected to go up by 2.5 cents in 2022. So if you are self-employed or work for an employer that reimburses mileage, using the standard rate will mean more money in your pocket!

If you use a vehicle for business, your expenses will be deductible based on the standard mileage rate. The rate is also subject to a 7.5% AGI limit. To claim mileage tax deductions, keep track of the Standard Mileage Rate and use it wisely. The IRS has announced updated standard mileage rates for 2022, effective January 1, 2019.

Exemptions from standard mileage rate

If you use your car for business, you may be wondering how you can deduct the cost of the miles. There were several methods of calculating deductible expenses in the past, but the standard mileage rate is the most commonly used. It allows a certain percentage of your business expenses to be deducted. The IRS sets the standard mileage rate each year. This year, the rate is 58.5 cents per mile, up 1.5 cents from last year.

There are several exemptions from the standard mileage rate. Business owners, self-employed individuals, and nonprofits can use them to calculate deductible expenses. Exemptions from the standard mileage rate include travel expenses for medical care or charitable activities and moving expenses. This rate may not apply to all businesses, but some people can use it to reduce the cost of driving for business. If you use your car for business, keep track of the mileage you drive to keep your business running smoothly.

Whether to claim vehicle expenses instead of mileage

Depending on your business model, you may be able to claim vehicle expenses instead of mileage for business purposes. A vehicle expense is an amount that you incur for operating the vehicle. The standard mileage rate is an excellent place to start. It covers various expenses related to car ownership, such as gas, oil, tolls, and parking fees. It is also excluded from accelerated depreciation. The IRS sets the standard mileage rate every year.

A flat rate for vehicle expenses helps you calculate your business’s actual costs, such as gas and insurance. On the other hand, the standard mileage method lets you deduct the standard rate for each mile you drive for business purposes. For 2017, this rate was 53.5 cents per mile, while for 2016, it was 54 cents per mile. If you drive 1,000 miles for business purposes, you can claim $535.